Afterpay Limited abbreviated as Afterpay or ABT is an Australian public financial technology company that is operating in Australia, the United Kingdom, the United States, Canada, and New Zealand. Afterpay is founded by Anthony Eisen and Nick Molnar in 2015. In 2017, Afterpay merged with Touchcorp (one of its technology suppliers) to form the Afterpay Touch Group. In November 2019, the company was renamed Afterpay Limited. Afterpay is the leader in “Buy Now Pay Later” payments, which allows its customers to receive products immediately and pay in 4 simple installments.

Index:

How does Aftepay works?

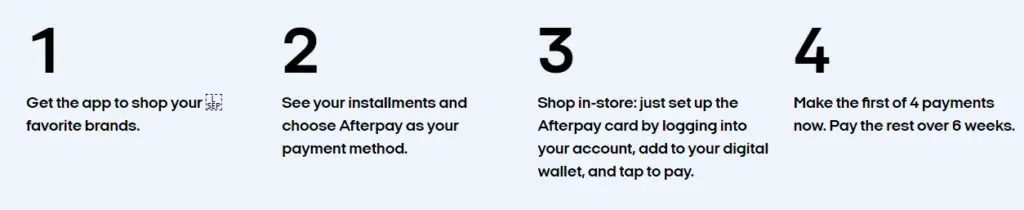

Afterpay pays the retailer in advance for the goods – and then the customer pays Afterpay back. While you may get the instant indulgence of your purchase, you’ll need to commit to making four fortnightly payments over eight weeks. These payments are of equal value for each order and are interest-free which is a relief for the customer. So, it is both online as well as in-store. You just have to follow these steps to know how it works separately:

SHOP ONLINE

- Browse your favorite stores: Just pick up which store you want to shop.

- Choose Afterpay as your payment method: When you are done with shopping online choose which payment method you want.

- Instantly create your account and complete your purchase: When you are done with choosing what payment you want, create your account on Afterpay and complete your purchase.

SHOP IN-STORE

- Browse your favorite shops in-store: Go in store and shop all youneed.

- Download Afterpay App: After that download the Afterpay App from the play store.

- Instantly create your account: Create your account on the Afterpay App.

- Tap the card tab and follow the instructions to set up the Afterpay card and add it to your digital pocket: It is advisable to do this point with cool mind as it will need your details.

- Go to a retailer who accepts Afterpay: After going to the retailer activate your Afterpay card in the app and pay using either Apple Pay or Google Pay.

Business Model:

Now, let us have a look on the business model of Afterpay:

Key Partners:

The main partners of the company are its third-party merchants. The other key partners of Afterpay are Pay Later (Afterpay) and TouchCorp.

Key Activities:

The key activities of the company are to provide security to customers by providing support 24X7, creating effective research and development programs. The company undertakes distribution of finance, production, and implementation of sponsors, and managing the investors of the company.

Key Resources:

The partnerships made by the company, the Afterpay platform provided to the users, the efficient research and development team of the organization, the existing market position that has been gained by the company are all the key resources of Afterpay.

Value Propositions:

The reason behind Afterpays’ successfully penetrating into the international market is its strong value propositions. Interest fee payments for the customers, paying to the merchant through four installments, secure multi-currency, multi-payment transaction platform provided to the customers, user-friendly website which can easily be used by the customers is some of the versatile value propositions used by the company, that works at all levels of scale.

Customer Relationship:

Afterpay always believes in a long-term relationship with its customers. It provides free membership to its customers, provides different methods of payment, and providing customers with support related to any query.

Customer Segments:

Afterpay creates values for its customers. They wanted to provide all the benefits they can give to their customers. The most important customers of Afterpay are businesses, merchants, retailers, and shoppers.

Channels:

The channels of the company are the website of the company, programs and advertisement by the partners, online and digital advertising, and social media advertisements.

Cost Structure:

The online shop Afterpay is charged a flat fee of 30 cents and a commission that varies with the value and volume of transactions processed by using Afterpay. The fee ranges from 4 percent per transaction to 6 percent per transaction i.e. the more you sell, at a higher value, the lower the percentage fee will be.

Revenue Streams:

Afterpay doesn’t charge customers to use its services, instead makes money by charging retailers fees for offering services. Afterpay also makes money by the fees it charges merchants as well as for late payments. Furthermore, the company generates revenue from its foreign subsidiaries, including Clearpay, which the company operates in the United Kingdom. The revenue of Afterpay is AU$251.6 million (June 2019).

Valuation, expenses, and revenue of AfterPay:

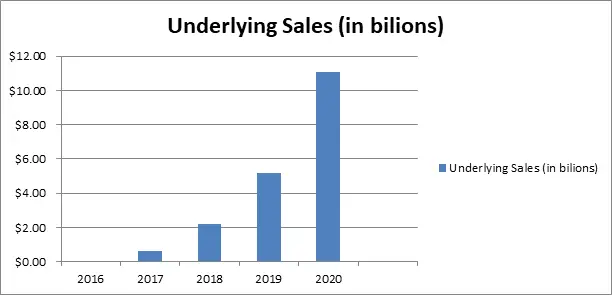

At the time of IPO, Afterpay was valued at $1.6 billion, as of the time of writing; the firm’s valuation has risen to over $47 billion. For the fiscal year 2020, the company Afterpay reported revenues of $519.2 million up 97 percent from in the previous year ($264.1 million). Now, let us see the sales figures on the graph:

Investor’s details and funding:

The company Afterpay has raised a total of $448.7 million across 3 rounds of funding, investors include Coatue, Tencent, and Mitsubishi. The company raised another $25 million (during its stock market debut) in June 2017.

Competitor analysis of company:

Afterpay has a number of competitors, some of them are:

Is Afterpay profitable?

Afterpay is on verge of breakeven, the company is to incur a final loss in 2021, before generating positive profits of AU$65m in 2022.

Do Share Your Thoughts:

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, do check useful Startup Resources and Tools below and do join our newsletter 📰 for free for more interesting Business Case Studies 💰, Startup Insights 🚀, and Startup founders podcast 🎙️ delivered to your inbox every Sunday morning.

Do follow us:

Related Articles:

- Affirm Business Model: How Affirm makes money?

- Microsoft Business Model: How Microsoft Makes Money?

- Honey Business Model: How Honey makes money?

- Venmo Business Model: How Venmo makes money?

- Cave Shake(Space Shake): What Happened After Shark Tank?

- Sarah Oliver Handbags: What Happened After Shark Tank?

What is Afterpay?

AfterPay allows in-store and online customers to purchase a product immediately and pay for it later.

Who founded Afterpay?

Afterpay was founded by Anthony Eisen and Nick Molnar in 2015.