E-trade is a financial corporation also stylized as E*TRADE, is a subsidiary of Morgan Stanley. The company offers an electronic trading platform to trade financial assets which include common stocks, preferred stocks, mutual funds, futures contracts, exchange-traded funds, options, and fixed-income investments. The company also offers services for employee stock ownership plans, advisor administration, margin lending, cash management services, and online banking. The company was founded by William A. Porter and Bernard A. Newcomb in 1982 in Palo Alto, California, the U.S. with the capital of $15,000. Its headquarters is in Arlington, Virginia, the U.S. With so many revolutions within the company, it was finally acquired by Morgan Stanley in October 2020.

Index:

How Etrade works?

1. Consider which type of account you want and fund it:

Firstly you have to choose which type of account you want to open, as Etrade gives you many options and then fill out the application form. The accounts offered by Etrade are:

- Brokerage accounts

- Retirement accounts

- Managed Portfolios

- Small business retirement accounts

2. Fund your Etrade account:

You can choose any options you like, like:

- By transferring money online

- By wire transferring

- Transfer an account (brokerage accounts only)

- By mailing a check

3. Leverage the online tools to develop an investing plan:

To make the investing plan well balanced, it should be based on 5 simple principles:

- Choosing right investments

- Diversification

- Understanding risk and reward

- Rebalancing to stay on track

- Sticking to your plan: One should create a well-balanced plan by actually following the Etrade website as it offers a number of tools and resources designed to help investors:

- Analyze a portfolio

- Creating an asset allocation

- By diversifying a portfolio

- Building a retirement plan

- By learning more about the markets and investing

4. Find investment ideas:

- Find the individual investments that match your plans and goals. Etrade provides:

- A large selection of investment choices, as you can literally choose from tens of thousands of ETFs, mutual funds, bonds, etc.

- Tools and screeners designed to help the users narrow down the vast number of potential investments and you to choose specifically the choices that match your plans and the criteria that you have chosen.

- You can also go through market data if you want to get real-time price quotes and use a range of customized charts and risk management tools.

- Investors have 24×7 access to screeners, research, chart, and other tools related to Etrade, so users can use it anytime they want.

5. Execute your traders:

- You can use an online Etrade trading ticket to place orders, you can immediately check the effects of your trades or market changes by your portfolio update. You can also place trades using the Etrade app for iOS as well as for Android.

6. Monitor your accounts and assets:

After logging in you can see Etrade assets and accounts on one screen on the Complete view page. If you want to deep digger you can go to individual items to have a look at the details of your accounts and the assets you hold.

7. Watch the markets: Etrade provides its users all the tools and resources to keep a tab on the markets or tracking individual stocks, funds, bonds that aren’t currently available in your portfolio. These can include, watch lists, alerts, mobile alerts, market news, and commentary.

Business Model:

Key Partners:

The company was acquired by Morgan Stanley in October 2020. There are many partners of Etrade like Consumer International, CUTS International, Diplo, United Nations Economic Commission for Africa, ECLAC, EIF, ESCAP, ESCWA, IAP, ITC, IDB, ILO, Internet Society, itfc, ITU, South Centre, UNCDF, United Nations UNCITRAL, UNCTAD, UNECE, UNIDO, UPU, World Bank, World Economic Forum, WIPO and WTO OMC.

Key Activities:

Etrade is known for online trading, but that’s not all Etrade uses lots of ways to make your money work harder with all seamlessly integrated and with value beyond the price. Etrade actually teaches you the basics of investing, advanced trading, retirement planning, tax planning, and events.

Key Resources:

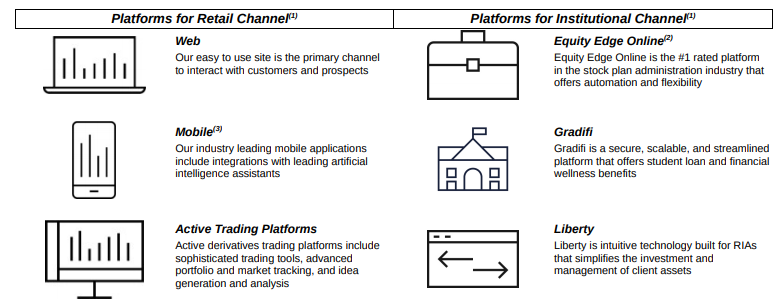

Etrade can give you services on its website, where you can find many resources to trade financial assets common stocks, preferred stocks, mutual funds, futures contracts, and many more.

Value propositions:

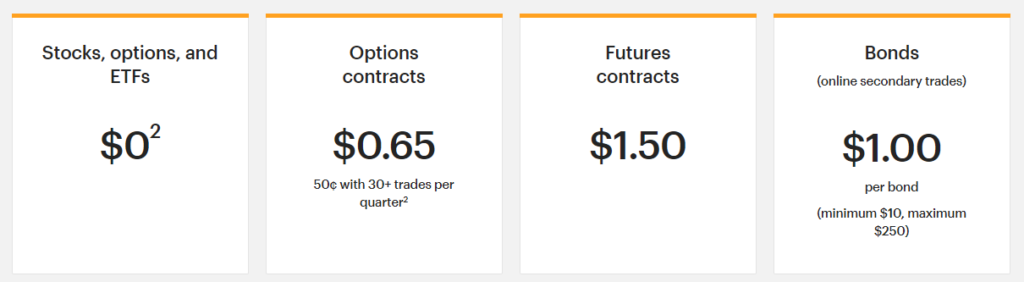

Etrade has one of the most unique value propositions. The creative agency selection comes as Etrade continues in its work to have organic growth and to improve market share within its core brokerage business. The standard options contract fee of Etrade is $0.65 per contract or we can say $0.50 per contract for customers who execute at least 30 stock, ETF, and options trades per quarter.

Customer Relationship:

Etrade aims to enhance the financial independence of its investors and traders. It offers a powerful digital offering and professional guidance. Etrade has 5.2 million clients as of February 2020.

Customer Segments:

The most important customers for Etrade are retail investors that reward the customer’s overall relationship with the company. Etrade also makes a grab for smaller investors.

Channels:

Etrade tries to reach its customers in all possible ways. Etrade wants to give to its customers all the services in investing, corporate services, advisor services, or even in banking and cash management.

Cost Structure:

Etrade charges the standard options contract fee which is $0.65 per contract. Though it is $0.50 per contract for customers who execute at least 30 stock, ETF, and options trades per quarter. For opening general trading and investing accounts, the Etrade brokerage account, and trust and estate account, the amount required is a minimum opening deposit of $500. But if for active trading accounts, power Etrade accounts then it requires a minimum opening deposit of $1,000, while Futures Trading accounts require $10,000.

Revenue Streams:

Etrade earns revenue in two ways: through order flow and through interest on the free float. Etrade invests the interests he earns from the customer funds in the money market. Additionally, the company makes a profit when users borrow margin from Etrade to buy or short stocks.

Valuation, expenses, and revenue:

Etrade is the full package for traders with instinctive tools and specialized support. As of March 2021, the net worth of Etrade (Groupon) is $1.7 billion. In the second quarter of the year 2020, the net income generated by Etrade is $196 million. Etrade generates diluted earnings per common share of $0.88 in the year 2020. The net total revenue generated by Etrade in the second quarter is $716 million.

Competitor Analysis:

Etrade’s top competitors are:

- TD Ameritrade

- Interactive Brokers

- Robinhood

- Swissquote Group

- Merrill Edge

SWOT Analysis of Etrade:

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strength:

- Etrade has a wide customer base.

- Etrade has broad outreach.

- Etrade has a great free offering.

Weakness:

- Because of service based offering significantly increases the need for more employees.

Opportunities:

- Etrade has the ability to scale other markets with ease.

- Etrade can increase its outreach to lower-income groups.

Threats:

- Etrade is now competing against other brokers like Webull, Aly Invest, and others because of the emergence of discount brokerages which will create more competition.

Do Share Your Thoughts:

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, do check useful Startup Resources and Tools below and do join our newsletter 📰 for free for more interesting Business Case Studies 💰, Startup Insights 🚀, and Startup founders podcast 🎙️ delivered to your inbox every Sunday morning.

Do follow us:

Related Articles:

- ChaCha Business Model Breakdown: Why ChaCha failed?

- Peloton Business Model: How Peloton makes money?

- Zelle Business Model Breakdown: How Zelle makes money?

- Robinhood Business Model Breakdown: How Robinhood makes money?

- ALDI Business Model Breakdown: How ALDI makes money?

- Afterpay Business Model: How AfterPay makes money?

What is E-trade?

E-trade is a financial corporation also stylized as E*TRADE, is a subsidiary of Morgan Stanley. The company offers an electronic trading platform to trade financial assets which include common stocks, preferred stocks, mutual funds, futures contracts, exchange-traded funds, options, and fixed-income investments.

Who founded E-trade?

The company was founded by William A. Porter and Bernard A. Newcomb in 1982 in Palo Alto, California, the U.S. with the capital of $15,000.