Saudi Aramco officially known as the Saudi Arabian Oil Company is a Saudi Arabian public petroleum and natural gas company.

Saudi Aramco has both the world’s largest daily oil production and second-largest proven crude oil reserves, at more than 270 billion barrels of all oil-producing companies.

Saudi Aramco also operates the world’s largest single hydrocarbon network namely, the Master Gas System. Saudi Aramco also operates the world’s largest onshore oil field, Ghawar Field, and the Safaniya Field, the world’s largest offshore oil field.

Saudi Aramco is founded in 1933 by Kenneth R. Kingsbury and Abdullah bin Suleiman Al Hamdan and its headquarters is in Dhahran, Saudi Arabia.

Index:

How Saudi Aramco works?

Saudi Aramco is a global petroleum and natural gas company that invests internationally. Saudi Aramco expanded its presence internationally so that it can include the three major global energy markets of Asia, Europe, and North America.

Saudi Aramco has signed a deal with the South Korean oil refiner Hyundai Oil Bank to acquire a 13% stake for US$1.24 billion, in April 2019. Saudi Aramco also signed an agreement with PKN Orlen on 11 April 2019, which is Poland’s leading oil refiner, to supply it with Arabian Crude Oil.

Saudi Aramco is also planning to be a major producer of LNG in the world and it sold its first cargo of LNG from Singapore to an Indian buyer. The company is looking internationally for potential joint ventures and partnerships to achieve its goal regarding the LNG market.

The company also believes in making healthy relations with the employees and giving them a pleasant work environment as they think it will be beneficial for the company. Saudi Aramco compensates employees well and provides many perks.

Management changes can often create a disordered unaccountable environment where major gains in personnel or process performance can be lost quickly. And this is how one of the world’s most profitable companies works.

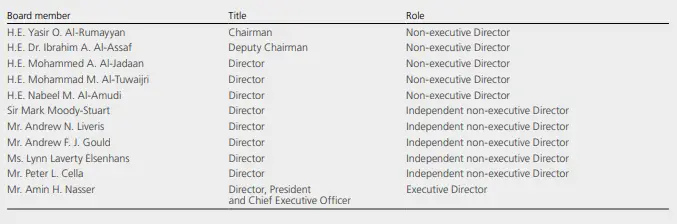

Below is the list of board members of Aramco who oversee overall management and supervision

of the Company and provides strategic leadership, and guidance to management to assess opportunities, risks, and risk mitigation controls of the Company.

Business Model:

Key Partners:

Saudi Aramco has so many key partners and also joint ventures.

Some of them are Johns Hopkins Aramco Healthcare, Saudi Aramco Lubricating Oil Refining Company, Power Cogeneration Plant Company, Rabigh Refining & Petrochemical Company, Fadhli Plant Cogeneration Company, Wisayat Al Khaleej Investment Company, Aramco Power, Aramco Overseas Company, Europe, Aramco Services Company, North and South America, Saudi Aramco Asia Company Ltd. Beiging, China, Dhahran Techno Valley Company, Women Business Park, etc.

Key Activities:

The key activities of Saudi Aramco are operations that move around the globe and include exploration, production, refining, chemicals, distribution, and marketing.

Saudi Aramco’s main business is taking out the oil from the ground and selling it into the international export market, where its biggest customers are in the U.S., India, and China.

Key Resources:

Crude oil production petroleum refining petrochemicals ammonia and industrial gases, sodium hydroxide, cement fertilizer plastics metals ship repair aircraft repair construction, oil, gas, harnessing the power of chemicals, refined products, retail fuels and power systems are all the key resources of Saudi Aramco.

Value propositions:

From transportation fuels to advanced materials, the company’s diverse and expanding range of products creates value not only for its customers, but also for the company, partners, and shareholders. The company manages the Kingdom’s unique hydrocarbon reserves base and optimizes production and maximizes long-term value.

Saudi Aramco operates a strategically desegregated global downstream business. Saudi Aramco delivers upstream production to a high-quality external customer base and a devoted downstream system.

Saudi Aramco also provides high-value products to the Kingdom and internationally in large and high-growth markets, through supply, trading, distribution, and retail operations. These all are the values company delivers to the customers.

Customer Relationship:

There is always a supplier-customer relationship between Saudi Aramco and different countries but the operations of the company span around four areas of services, i.e. business origination, marketing, quality management, and strategic sourcing and supplier relationship management.

Customer Segments:

Saudi Aramco’s target market is in Asia as it sends 70 percent of its exports. The company is the biggest supplier to six major markets in Asia, they are China, India, Japan, the Philippines, and South Korea.

Channels:

Saudi Aramco has many channels through which they can be reached through customers like via government of countries, social platforms such as Facebook, Twitter, etc. Saudi Aramco keeps in touch with the countries.

Cost Structure:

Value of operating costs of Saudi Aramco from 2017-2019, the operating costs of Saudi Aramco in 2019 was approximately 150 billion U.S. dollars and Saudi Aramco was ranked the most profitable company all over the globe according to its credit rating, leaving behind Exxon mobile or Apple.

Revenue Streams:

The revenue of Saudi Aramco in the year 2020 was a loss of US $229.9 billion, because of the worldwide pandemic i.e. coronavirus or covid-19.

Valuation, expenses, and revenue:

In 2019, Saudi Aramco went public with an IPO, raising a record $25 billion by selling three billion shares. This amount was only 1.5% of the company’s value, which is significantly lower than what most companies distribute.

Competitor Analysis:

- Conoco

- Abu Dhabi National Oil

- PEMEX

- CNPC

Is Saudi Aramco profitable?

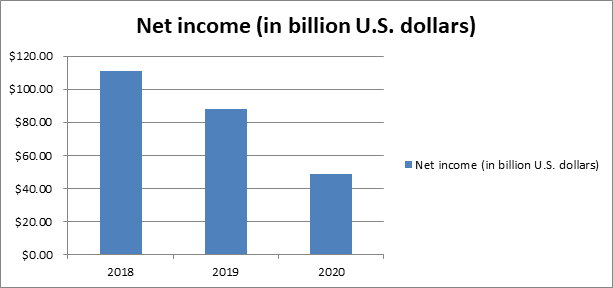

Saudi Aramco is one of the most profitable companies in the world, in 2019, the company has been listed as the world’s most profitable company of the world, the current status puts the company behind Apple in 2020. Now let us see the graph of past 3 years of profits of the company:

Do Share Your Thoughts:

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, do check the useful Startup Resources and Tools below, and do join our newsletter 📰 for free for more interesting Business Case Studies 💰, Startup Insights 🚀, and Startup Founders podcast 🎙️ delivered to your inbox every Sunday morning.

Related Articles:

- ChaCha Business Model Breakdown: Why ChaCha failed?

- Peloton Business Model: How Peloton makes money?

- Zelle Business Model Breakdown: How Zelle makes money?

- Robinhood Business Model Breakdown: How Robinhood makes money?

- ALDI Business Model Breakdown: How ALDI makes money?

- Afterpay Business Model: How AfterPay makes money?

What is Saudi Aramco?

Saudi Aramco officially known as the Saudi Arabian Oil Company is a Saudi Arabian public petroleum and natural gas company. Saudi Aramco has both the world’s largest daily oil production and second-largest proven crude oil reserves, at more than 270 billion barrels of all oil-producing companies.

Who founded Saudi Aramco?

Saudi Aramco is founded in 1933 by Kenneth R. Kingsbury and Abdullah bin Suleiman Al Hamdan and its headquarters is in Dhahran, Saudi Arabia.