Groupon is an American global e-commerce marketplace connecting subscribers with local traders by presenting activities, travel, products, and services in 15 countries. Based in Chicago, Groupon changed into released there in November 2008, launching quickly after in Boston, New York City, and Toronto. October 2010, Groupon made itself available in a hundred and fifty towns in North America and one hundred towns in Europe, Asia, and South America and had 35 million registered users. By the cease of March 2015, Groupon served more than 500 towns worldwide, nearly48.1 million active clients, and featured greater than 425,000 active deals globally in forty-eight countries.

Founder

Andrew D. Mason (born 1981) is an American businessman and entrepreneur. He is the founder and former CEO of Groupon, a Chicago-primarily based on the website providing customers reductions on nearby companies and scholarships. He is likewise the founder and CEO of Descript, an audio enhancing device for podcasters.

Mason grew up in a Jewish family in Mount Lebanon, Pennsylvania, a suburb of Pittsburgh. He graduated from Mt. Lebanon High School in 1999 and started a Saturday morning shipping provider called “Bagel Express” whilst he turned into the elderly 15.

After graduating from Northwestern University in 2003 with a diploma in music, Mason labored in Webdesign for Chicago entrepreneur Eric Lefkofsky

Mason stopped running with Lefkofsky to wait for the University of Chicago’s Harris School of public policy after he turned into presented a scholarship. However, he dropped out of his master’s diploma software numerous months after it started. Mason also interned and labored at distinguished Chicago recording studio, Electrical Audio, beneath neath recording engineer Steve Albini, whom Mason mentioned as a proposal on his subsequent work ethic.

Business model of Groupon

So, the channelization of the business model of Groupon is primarily based on the products and services of their preference at a reduced price.

In the process:

• Consumers purchase services and products at a reduced price

• Merchants meet with a much broader base of qualified local clients

There isn’t any doubt about the fact that Groupon is one of the most amazing and famous organizations that we’ve in the enterprise of Online Deal Marketplacethese days.

The organization is known to be the quickest enterprise that ever reached the valuation milestone of one billion dollars the first time. So, there is no doubt that this organization is something which you want to know about for sure.

We wouldn’t be incorrect if we are saying that this organization is one of the pioneering names with regards to the web offers those days.

Groupon, as an organization, has controlled to seize a role withinside the online platform international wherein the customers can find out positive activities or see or eat or purchase and store the matters as well.

The organization could be very plenty regarded for the truth that the customers locate the site quite smooth to apply as well.

Working of Groupon can be understood as an intermediary who makes money from the exclusive connections that it makes among the clients and the businesses.

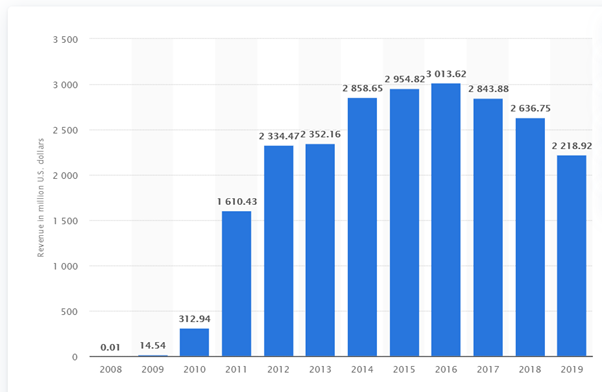

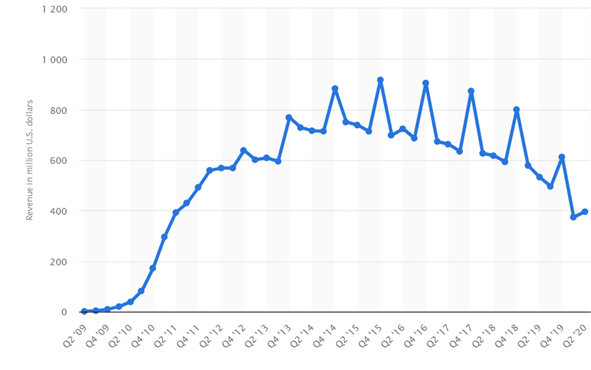

REVENUE OF GROUPON

![]()

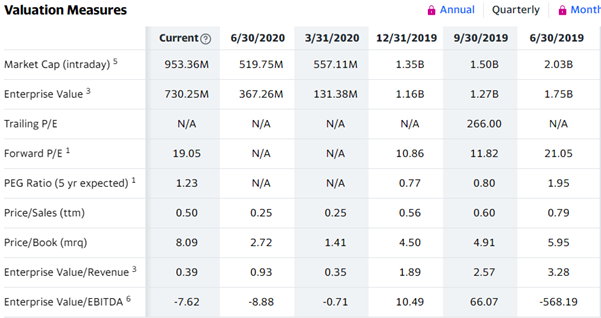

GROUPON VALUATION

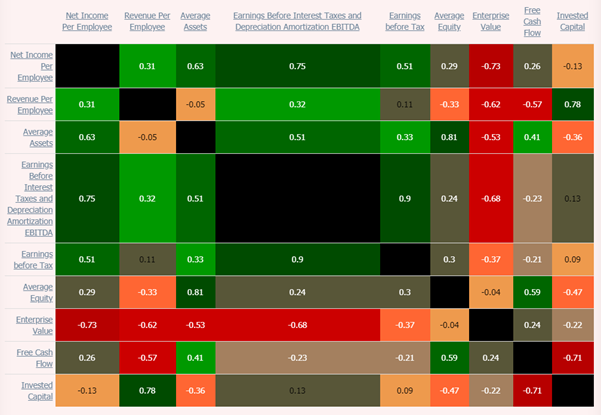

Many accounts on the financial statements of Groupon are highly interrelated and sometimes correlated. Consequently, when conducting Groupon’s valuation analysis, one should examine all of the accounts reported to obtain a complete picture of its financial situation. We provide a unique feature to present a conventional correlation table purposely composed against different valuation-related drivers of Groupon

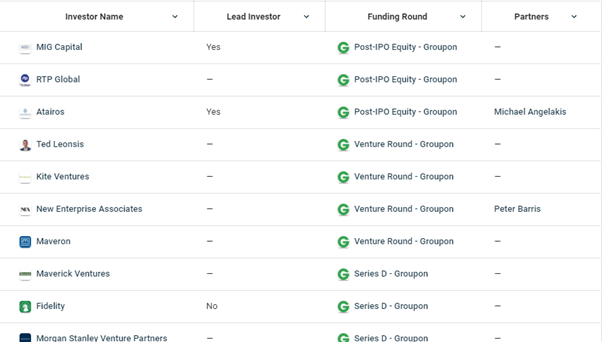

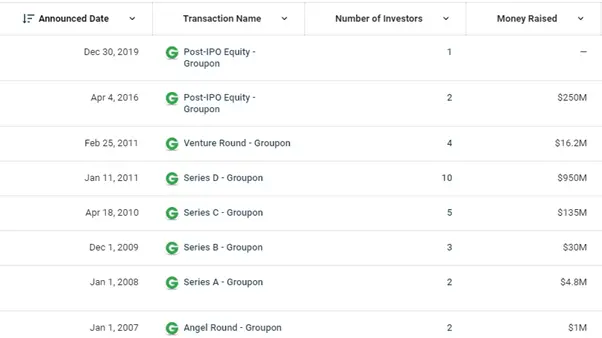

Funding and investors

Investors

Competitor of Groupon

Amazon.com

Amazon.com Inc. (AMZN) is the juggernaut of online shopping whose market cap is closing in on one thousand billion dollars. Amazon’s flagship service, AmazonPrime, has helped the employer dominate the net and cellular marketplaces. Prime gives two-day shipping across the USA to its subscribers and even equal-day transport for relevant products.

In addition to transport services, Prime gives streaming from Amazon’s library of movies, shows, and music. It gives analyzing from its ebook library and cloud offerings for customers to shop photographs and different media fora a year price of $119. It’s estimated that Amazon has over a hundred and fifty million prime subscribers. Amazon’s achievement with Prime, offerings, and e-trade offerings have propelled the employer’s inventory over the years.

Walmart

Coming off its $3.3 billion acquisition of Jet.com, Walmart Inc. (WMT) continues to expand similarly into the e-commerce and phone market to attract customers who’re seeking to save cash, encroaching similarly onto not only Amazon’s turf however Groupon’s as well. Like Amazon, Walmart gives a slew of offerings in addition to its eCommerce platform.

Walmart’s network of shops throughout the USA permits clients to pick up objects they ordered online on the same day, and the employer gives free two-day transport to its online clients. Walmart additionally has a mobile payment platform, Walmart Pay, which it makes use of to provide reductions and benefit insights into its customers’ preferences.

Rakuten

Rakuten is another famous enterprise that online customers use to save cash on their purchases. Similar to Groupon, people can set up a Chrome extension or swipe the website to have cashback on famous web sites once they test out. Rather than pre-shopping the discount, Rakuten permits clients to save cash without delay at checkout with a rebate.

Is the company profitable?

According to Erin Griffith over at Fortune, Groupon is sincerely growing as a company, however, it simply isn’t always making any real profit.

It grew sales by 24% last yr. Revenue is predicted to grow 11% this year. But Groupon has suggested an internet income loss for each year it’s been public, together with closing year, when it lost $ seventy-three million. That’s now no longer possible to change, due to the fact Groupon is a company that has to overcome the terrible enterprise model.”

How exactly does one “lose” $ seventy-three million whilst you are raking in the $7.6 billion human beings spent closing 12 months at the site?

There are 3 motives for this. In the one case, Groupon is suffering to compete in a marketplace (local, online deals) where there’s an ever-increasing series of competitors — Amazon Local being one of the ultra-modern and most threatening.

To compete, Groupon has had to ramp up its investments in advertising and marketing itself to traders which can be greater famous among consumers, however that still commonly way smaller-sized deals.

Amazing facts about Groupon

Groupon turned down a deal from Google for $6 billion in 2010. The online deal broker became an IPO the next year.

Do Share Your Thoughts

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, do check useful Startup Resources and Tools below(👇) and do join our newsletter for free for more interesting Business case studies, Startup knowledge, and Startup founders podcast delivered to your inbox every Sunday morning.

Do follow us:

Related Articles

- How Yulu Works and Makes Money?

- Understanding how ALIBABA works and makes money?

- How TikTok Makes Money?

- How Ola Makes Money?

- Understanding how does share chat work?

- How OYO Rooms Makes Money?

- How Candy Crush Makes so much Money?

- Understanding how do Elon Musk’s Tesla works?

Do follow us:

.

I cannot thank you enough for the blog article. Really thank you!

I cannot thank you enough for the blog article. Really thank you!

This article is truly a fastidious post, keep it up.