Circle was the Paypal of Bitcoin. They wanted to exchange cryptocurrency easily across the globe. They were the first ones to receive a BitLicense issued by the New York State Department of Financial Services. Besides coming early into business why couldn’t they flourish?

Also, don’t forget to download our Android app which contains startup case studies and business book insights, verified business concepts, and no bullshit!!

Index:

Founder Details

In October 2013, Jeremy Allaire and Sean Nevile together established the Circle. It was based in Boston, Massachusetts. Their aim was to build an internet-based consumer finance company to develop the power of digital money.

Revenue Model and Sources

Circle apps and products were completely free to download from the app store. Nor the company charged any fee for transactions through the Circle Pay app.

All the revenue generated was only through trading (Circle Trade). Over 3 months of period revenue generated through trading was $60 million. Circle managed over $2 billion in monthly transactions. This was their main source of income to them.

In August 2017, Circle became the biggest Crypto asset trader in the whole world. Co-Founder Sean Neville’s vision was to keep the basic product free and revenue- generation through higher-level products. In June 2019, Circle also entered China enabling the flow of payments going in and out of China.

Funding and Investor Details

- Between 2013 and 2016, Circle has undergone 4 rounds of funding and was able to receive US$135 million. This included a US$50 million investment from Goldman Sachs. This helped then solidify their existence to deal with cryptocurrency.

- Backed by new and existing partners in June 2016, Circle raised US$60 million in Series D funding.

- Total of 27 investors funded Circle. Among them, the Asian Cowboy and Digital Currency Group were the most recent.

Business Model

They started the company with a mission in the mind of changing the global economy.

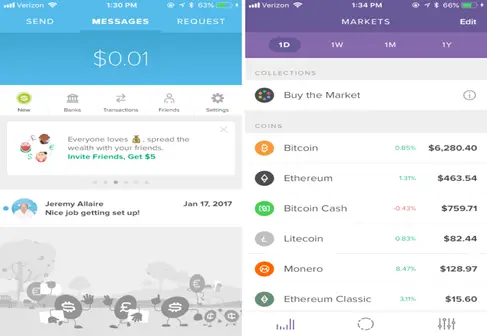

- Circle Pay: Circle started off by creating a cryptocurrency payment app called Circle Pay. It was a Bitcoin trading exchange between currencies, countries, and friends.

- Circle Invest: It allows you to invest in Bitcoin, Ethereum, and other wide range of cryptocurrencies. Customers can buy and sell crypto assets in just one tap. The minimum purchase limit is only $1 for new users to try dealing with and learning about crypto assets.

- Circle Trade: This mainly focused on OTC with large exchanges and cryptocurrency investors. They were one of the largest liquidity providers of digital assets globally.

- Circle Research: For better-informed decisions, Circle launched Circle Research to provide detailed information in crypto asset-specific research, crypto market research and everything about digital currency. They aimed to provide right information covering basic features, risk and challenges associated with crypto assets. This saved a lot of leg work for users in separating fact from fact.

- Poloniex: In 2014, Poloniex was one of the most renowned names in the world of digital exchange names. Circle paid $400 million to acquire Poloniex in February 2018, the biggest step taken by the company. Unfortunately, Poloniex spin out of the circle after 2 years of acquisition.

- Circle Centre: Circle also opened a source project naming Centre after Cent Routing Exchange Protocol. App enables transfers of currency using Centre tokens, an Ethereum token. It supported different currencies.

Circle initially focused on circle pay, a customer target app to enter the market of cryptocurrency. They moved at a fast pace to attain a license for operating in exchange for cryptocurrency. Expanding the use of Circle services to the United Kingdom, it was successful in attaining Britain’s Financial Conduct Authority’s license in electronic money by April 2016. They focused on reducing costs on international money transfer. The Circle Pay app has become quite popular because of the free money transfer service. Ultimately, this app leads to revenue loss for the company.

Competitor Analysis

Gemini

Gemini is very similar to Circle, also a digital currency exchange company. It was founded by Cameron and Tyler Winklevoss, based in New York. They created a system of private keys and a password protected for purchase and storage of Bitcoin.

Paxos

Another New York-based financial institution was founded by Charles Cascarilla and Richmond Teo. Their mission is to re-building financial infrastructure.

Tether

Tether holdings is a platform to send, store, and receive currency globally, with headquarters based in Hong Kong. Tether Limited launched its own cryptocurrency called Tether.

Failure Analysis

Circle discontinued its Circle Pay app on September 30, 2019.

- The main reason for discontinuation was because the company was not earning a penny from the app. As the services involve no charges on transactions, the company had no positive cash flow. Though the app initially was very useful for the company by bringing fame. But the app was not profitable. So the company started focusing on new crypto financial products.

- Cryptocurrency is still something unknown for common people, only people interested are crypto investors who are involved in large trade.

- The general perception crypto holds in the mind of people is that it is complicated to use and very risky. They are not ready to accept it as a currency. What customers seek is certainty, transparency, and secure financial infrastructure.

- Circle also faced many restrictive regulatory climates in the U.S. They wanted a more balanced crypto policy in the U.S. to freely give transaction services.

- Crypto business is becoming super competitive with decreasing margins. Under the market competitiveness, they had to provide services for free, making it very difficult for them to generate profits.

- 2018 was known to be a cryptocurrency crash, Bitcoin fell about 65% in that year. This crash was more severe than the Dot-com bubble crash. The majority of companies faced huge losses with sudden fall.

Possible Fixes

Circle couldn’t keep their focus, they kept on bringing new products without being successful in one. They kept on changing the pivot. Introducing a new product doesn’t mean forgetting the other. If their goal was to focus on large trade then their start was wrong. It’s equally important to deliberately choose what not to do when there are a vast majority of options in front of you.

Shifting from one business model to another is no solution to earn money. People will simply not be attracted because you provide a lot to them. Instead that would be a destruction to them.

Do Share Your Thoughts

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, don’t forget to download our Android app 📱 which contains startup case studies and business book insights, verified business concepts, and no bullshit!!

Related Articles:

- Why Did PRIM Shutdown? Here is the complete analysis!

- Why Did VINE Fail? Here is their complete failure breakdown!

- What Happened To Weave? Here are the reasons for its failure!

- Why Did Stayzilla Fail? Check their Failure Analysis here!

- Why Did Rafter Fail? Check their Failure Analysis here!

What was Circle?

Circle was the Paypal of Bitcoin. They wanted to exchange cryptocurrency easily across the globe. They were first one to receive BitLicense issued by the New York State Department of Financial Services.

Who founded Circle?

In October 2013, Jeremy Allaire and Sean Nevile together established the Circle. It was based in Boston, Massachusetts.