TrustEgg was once known to change the U.S. savings rate, by claiming to save children’s future. They build a trust fund which works on investments by social networks of the child.

Why could they just survive for 5 years? Let’s know what went bad for them.

Index:

Founder Details:

Jeffrey Brice and John Zdanowski founded TrustEgg in 2011. Its headquarters is based in the Los Angeles Area, West Coast. Jeffrey Brice had 5 yrs experience in Banking and he also spent 2 years working for a trusted company.

He was passionate to build a trust fund with the power of social networks. He evoked such an idea after the birth of his niece. He envisioned after seeing her whole social saving network being present right there and thought to secure her future. He also noticed the demand for this plan in the U.S. by looking at the success of government trust plans.

Funding and Investor Details:

TrustEgg last funding was on Dec 20, 2013. They were able to raise a total of $1.2 M from just two rounds of seed funding.

They receive funds from 11 big investors which is quite a huge number to start with; Y Combinator was one of those.

| Investors |

| Rubicon Venture Capital |

| Y Combinator |

| Howard Love |

| David Vivero |

| Foresight Ventures |

| Innovation Garden |

| Brad Zions |

| Tech Coast Angels |

| HBS Alumni Angels |

| David Hehman |

Business Model:

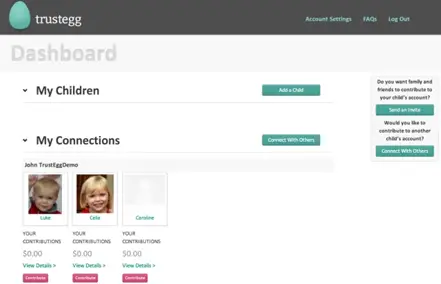

They designed a simple yet reliable system of opening an online trust account in just 60 seconds without requirements. Parents could easily sign up for their children to start a trust fund with no minimum requirements. The account opens at zero balance which is not a service bank fund would provide; hence the name TrustEgg taking the shape of an egg. Child futures had a head start from zero with no risk. A link is generated on the basis of an account that can be sent to family, friends, and acquaintances for them to donate into the account.

The company hosted its customer’s account in South Dakota. They chose this state for initial working because it was most welcoming for this kind of business. What was different about their business model was providing financial services products, this was not provided by the government. Users were attracted as the products could be sold through other banks as well. Brice’s motto was not to beat the market but in fact to get into the market.

Revenue Model:

Only charges users were to spend were an expense charge of 0.89% per year. Parents find the company reliable and find the investment worth trying. Expenses were minimal compared to the end results. The financial product and the quality service by the TrustEgg felt like a secure and better decision compared to other options.

Competitor Analysis:

529 plans

529 Plans is a plan by the U.S. Securities and Exchange Commission. A tuition plan having tax-advantage saving perks. It is made to encourage students to save for their future studies. But the co-founder Brice described it as really complicated and fragmented. People were not well-versed with this investment plan.

Gerber Plan

Gerber Plan is like any other life insurance plan targeted to new parents. The Gerber offers a Grow-Up plan wherein you pay a portion of the money as funds. Their funds grow each year with interest.

Failure Analysis:

They faced many hurdles which led to slow down and ultimately to the failure:

- Reach out to Audience:

TrustEgg failed to reach a large audience. Their presence remained hidden to most of the people. Besides being funded by 11 investors, they couldn’t balance out their investment areas. Investment in marketing is a stepping stone.

- Lack of Planning:

Mismanagement and lack of strategic planning were evident in their model. As we can see from the AIDA model (Awareness -> Interest -> Desire -> Action) awareness leads to interest. But if you fail at the very first step you can’t move forward.

- Ran out of money:

Ensuring a high return when profits are lower than expenses leads to epic failure. Making a long term well-applied revenue model is a must for trust funds.

Possible Fixes:

Trust funds should learn a little from the business model and marketing of life insurance companies. How are they able to get customers to sign their insurance policy? Firstly, they know their product inside out. They easily highlight how you would be benefited if you buy their policy. The same needs to be applied in trust funds.

TrustEgg was successful in becoming expertise in child funds, what they lacked was marketing tactics. If they have focused on telling parents that through TrustEgg you yourself generating funds for your children. TrustEgg would help you save in the most simplified manner while relaxing at home.

In this domain, there is no physical product to sell. So traditional marketing strategies come in handy. For people to trust in you, connections need to be built on a personal level with each and every customer you work with. They would surely love the attention you give to then. Get them convinced how important they are to you and beneficial is your product for their child’s future.

Make it a two-way process. Ask your customers if they faced any glitches while using your product, what they expect from the company. Also, give basic instruction to the new users. These are some changes that could have saved TrustEgg from failure.

Do Share Your Thoughts:

Do tell us all your thoughts in the comments section below, we look forward to reading all the comments in the section below.

Also, do check useful Startup Resources and Tools below and do join our newsletter 📰 for free for more interesting Business Case Studies 💰, Startup knowledge 🚀, and Startup founders podcast 🎙️ delivered to your inbox every Sunday morning.

Do follow us:

Related Articles:

- Why Did PRIM Shutdown? Here is the complete analysis!

- Why Did VINE Fail? Here is their complete failure breakdown!

- What Happened To Weave? Here are the reasons for its failure!

- Why Did Stayzilla Fail? Check their Failure Analysis here!

- Why Did Rafter Fail? Check their Failure Analysis here!

What is TrustEgg?

TrustEgg was once known to change the U.S. savings rate, by claiming to save children’s future. They build a trust fund which works on investments by social networks of the child.

Who founded TrustEgg?

Jeffrey Brice and John Zdanowski founded TrustEgg in 2011. Its headquarters is based in the Los Angeles Area, West Coast. Jeffrey Brice had 5 yrs experience in Banking and he also spent 2 years working for a trust company.